📣 Issue #4: Perplexity Launches Comet and Comet Plus

Plus: ChatGPT Go launches in India, Tool Spotlight: Nitrogen, hyper-personalized planning and more…

👀 Sneak Peek – What’s Inside This Issue

Here’s what we’re unpacking this week to help you stay ahead with AI in wealth management:

- 🚀 Perplexity Launches Comet – A browser that thinks with you. From summarizing pages to booking travel, Comet turns browsing into a cognitive process.

- 💵 Comet Plus Revenue Model – 80% of fees shared with publishers. A bold new take on AI + content economics.

- 💡 ChatGPT Go Debuts in India – Local currency pricing, ₹399/month (~$4.60), GPT-5 access, and advanced tools — expanding affordability and adoption.

- 📊 Tool Spotlight: Nitrogen – AI-powered financial planning that aligns risk, generates dynamic proposals, and automates monitoring.

- 📌 AI for Your RIA – From static to hyper-personalized planning: career shifts, values-driven investing, and real-time scenario testing.

- 📚 AI Essentials – Deep dive into tokens: why they matter, how they shape costs and limits, and what’s next for multimodal AI.

- 🛠️ How to AI? – Client Persona GPT: practice conversations with “The Ambitious Accumulator” before your next high-growth client meeting.

Let’s dive in.👇

🚦 AI Pulse: What’s New?

🚀 Perplexity Launches Comet and Comet Plus

Perplexity has introduced Comet, its new AI-driven browser, and Comet Plus, a $5/month subscription that shares revenue with publishers. Together, they signal a bold shift in how users browse the web and how content creators are compensated in the AI era.

What’s new:

- Comet is an AI-powered browser built on Chromium that acts as a seamless assistant—summarizing pages, booking travel, managing emails and calendars, automating tasks, and completing research directly from the browser interface.

- Comet Plus offers a publisher-friendly revenue model: 80% of subscription fees are paid back to content creators, with an initial $42.5M fund. Payouts are based on human visits, citations in AI search answers, and automated agent interactions.

Why this matters

- A new era of browsing: Comet moves beyond passive navigation, making browsing an interactive, cognitive process.

- Empowering content creators: Comet Plus redefines compensation—publishers get paid not just for clicks, but for meaningful AI-powered usage.

- Market reshaping: With lawsuits mounting against AI firms over content use, Perplexity’s cooperative model positions it as a more sustainable partner.

- Strategic move: By rolling out Comet to Max-tier users first and including Comet Plus in Pro and Max subscriptions, Perplexity strengthens both its consumer appeal and publisher relationships.

Bottom line

Perplexity’s launch of Comet turns the browser into a thought-partner, integrating AI into everyday web use. At the same time, Comet Plus experiments with a fairer publisher revenue model—sharing real economic value in the AI ecosystem. For users and creators alike, this marks a significant shift in how the internet works.

👉 Read more: Introducing Comet | Introducing Comet Plus

🆕 OpenAI Launches ChatGPT Go: Smarter Access for Every Day

OpenAI has introduced ChatGPT Go, a budget-friendly subscription tier now available exclusively in India at ₹399/month (~ $4.60 USD). It’s designed for lighter users who want more than the Free plan without committing to the Plus or Pro tiers.

What You Get with ChatGPT Go

- GPT-5 access — your conversations run on OpenAI’s flagship model

- 10× higher usage limits — more chats, image generations, and file uploads than Free

- 2× longer memory window — retain context across extended conversations

- Advanced tools included — file uploads, image generation, and data analysis

- Seamless local payments — subscribe directly in Indian Rupees via UPI, credit cards, or other local methods, removing reliance on USD pricing

Why It Matters

- Accessibility meets affordability: At just ₹399/month (~$4.60), ChatGPT Go costs a fraction of ChatGPT Plus (₹1,999/month), making advanced AI accessible to millions more.

- Local currency support: By pricing in INR and supporting UPI, OpenAI is meeting users where they are, lowering friction for adoption in one of its largest global markets.

- Bridge product: A middle tier that sits between the limited Free plan and the feature-rich Plus/Pro offerings, ideal for everyday creators, students, and professionals.

Early Highlights

With ChatGPT Go, users can:

- Chat more freely without hitting Free tier caps

- Upload and analyze files, turning ChatGPT into a daily productivity assistant

- Retain memory across longer conversations for better personalization

What’s Not Included

- No GPT-4o or legacy models — only GPT-5

- No Sora video generation (still Pro/Plus-exclusive)

- No Connectors (like Gmail or Google Calendar integrations)

Bottom Line

ChatGPT Go is more expansion than revolution, but it’s a significant move. By combining affordable pricing with local currency billing, OpenAI is making AI more approachable in a cost-sensitive, mobile-first market. For India’s huge base of students, creators, and professionals, ChatGPT Go unlocks powerful AI at a price — and payment method — that fits everyday life.

📊 Tool Spotlight: Nitrogen for AI-Powered Financial Planning

What it is:

Nitrogen (formerly Riskalyze) is a modern growth platform for wealth management firms that unites risk alignment, portfolio optimization, and client engagement. By blending behavioral finance with AI-powered automation, it helps advisors deliver personalized, compliant financial planning that strengthens trust and accelerates growth. (nitrogenwealth.com)

Why advisors love it:

✅ AI-driven risk alignment – Nitrogen’s signature Risk Number® quantifies each client’s comfort with risk, then aligns it with portfolios using advanced analytics, reducing misalignment and boosting retention.

✅ Dynamic proposals – Instantly generate visually engaging, AI-assisted proposals that make trade-offs—risk, fees, and performance—clear and simple for clients.

✅ Proactive monitoring – Nitrogen automatically tracks portfolios and market shifts, alerting advisors when client risk drifts or goals may be impacted.

✅ Built-in compliance – Automated documentation and transparent audit trails make every recommendation regulator-ready without extra effort.

When it makes sense to use Nitrogen:

✔️ If you want to personalize portfolios at scale, based on actual client risk tolerance and financial goals.

✔️ If you need to simplify complex conversations, turning volatility and probabilities into visuals clients can understand.

✔️ If you want to differentiate your practice with AI-enhanced client experiences that inspire confidence.

✔️ If you’re aiming to streamline compliance while maintaining focus on client relationships.

✔️ If you’d like to grow faster, using Nitrogen’s marketing and pipeline tools to convert prospects into clients.

How it compares:

- Traditional planning software – Strong for long-term projections, but often static and overwhelming. Nitrogen keeps the focus on risk, goals, and client clarity.

- Conventional questionnaires – Subjective and outdated. Nitrogen uses behavioral analytics and AI models for more accurate risk profiling.

- CRMs alone – Organize client data but don’t drive planning. Nitrogen connects data to action, bridging CRM with real-time advice.

Bottom line: Nitrogen blends risk intelligence, AI-driven proposals, and automated monitoring to help advisors deliver personalized, compliant, and growth-oriented planning.

Key takeaway:

Nitrogen transforms planning into a streamlined, AI-powered client experience—helping advisors grow by building clarity, trust, and confidence at scale.

👉 Explore Nitrogen and request a demo

📌 AI for Your RIA

From Generic to Hyper-Personalized: Smarter Planning with AI

For decades, financial planning has been built on broad categories — age, income, risk tolerance — producing plans that were more templates than tailored roadmaps. But one-size-fits-all isn’t enough anymore. Today’s clients expect advice that reflects their unique lives, goals, and values.

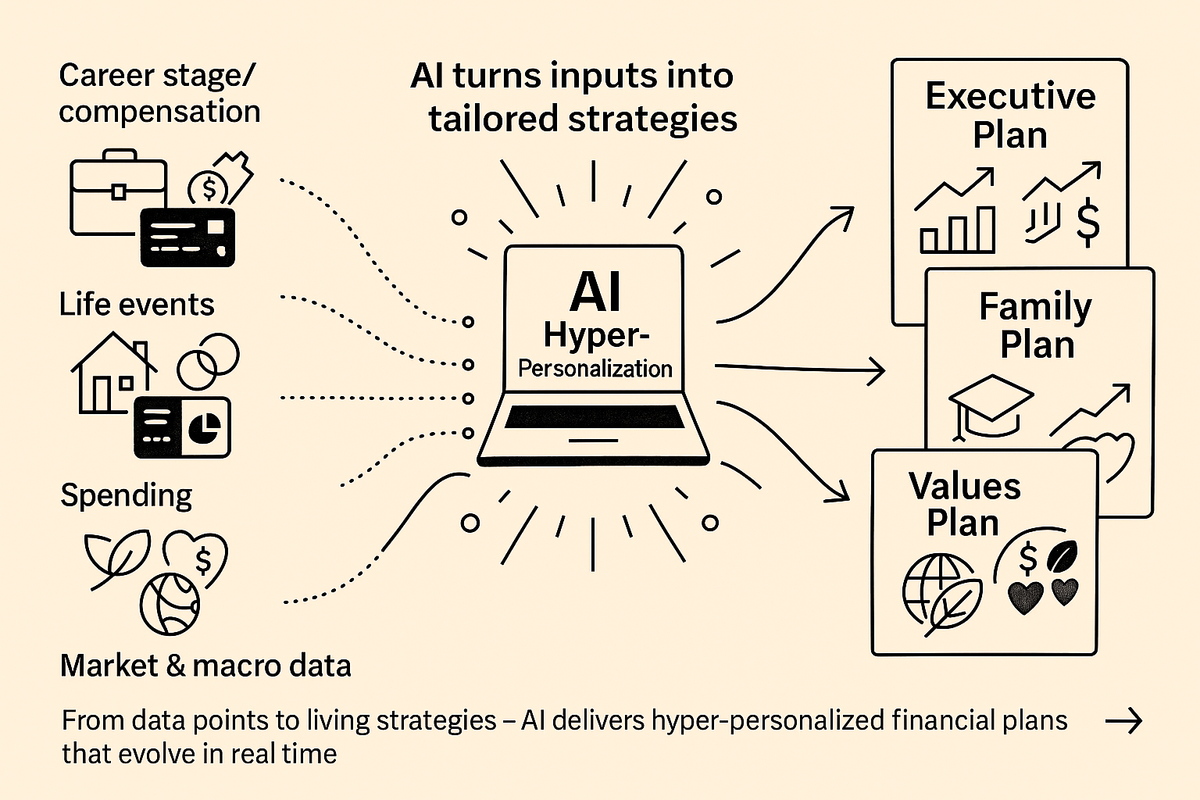

AI is transforming planning from static and generic to dynamic and hyper-personalized. By analyzing hundreds of data points per client and continuously adjusting as circumstances change, AI enables wealth managers to deliver living plans that truly evolve with clients.

This is already happening:

- Career-based modeling: Executives with RSUs or founders facing liquidity events get tailored tax, diversification, and cash-flow strategies.

- Spending pattern insights: AI tools detect lifestyle shifts and adjust savings or retirement projections in real time.

- Values-aligned investing: Platforms like YourStake and Ethic let advisors instantly craft portfolios around ESG or faith-based preferences.

- Dynamic scenario testing: AI-powered planning engines run thousands of “what-if” cases — from health costs to market shocks — to prepare clients for multiple futures.

- Adaptive communication: Natural language models turn technical outputs into explanations customized to each client’s learning style — whether they want numbers, visuals, or plain-English narratives.

Key takeaway:

Financial plans are no longer static PDFs that gather dust. With AI, they become living strategies that adapt in real time to career shifts, life events, markets, and personal values. Advisors who embrace hyper-personalization will not only build deeper trust but also create stickier, longer-term client relationships.

👉 For a deeper dive, check out this article on the future of hyper-personalized financial planning.

📚 AI Essentials

Deep Dive – Tokens: The Building Blocks of AI

AI models don’t read text like we do. They break everything down into tokens — tiny units such as words, parts of words, or symbols. The model predicts the next token to generate coherent answers.

🔍 What Is a Token?

- A token ≈ 4 characters of English text.

- Short word = 1 token (dog).

- Long word = multiple tokens (financialization → 2 tokens).

- Symbols can split ($100 → 2 tokens).

- 100 tokens ≈ 75 words.

🧠 Why Tokens Matter

- Cost – AI tools bill per token.

- Limits – Models can only handle a set number of tokens.

- Efficiency – Concise prompts save tokens.

- Memory – More tokens = longer conversations or documents.

🛠️ Quick Examples

- “Explain diversification.” (3 tokens) → vague.

- “Explain diversification with 3 analogies and 2 risks.” (~20 tokens) → tailored.

🚀 Tokens in 2025

- Context windows now stretch from 2k → 200k+.

- Models compress tokens for efficiency.

- Tokens now cover images, audio, even video.

- Experiments with token-free approaches are emerging.

🔮 What’s Next?

Tokens will fade into the background as AI gets cheaper, smarter, and more multimodal — but knowing how they work helps you use AI more effectively today.

🛠️ How to AI?

Practicing with Client Persona GPT

Numbers are the easy part. The challenge is anticipating how different types of clients will react to your recommendations. With a Client Persona GPT, you can simulate those reactions and practice refining your message — before the real meeting.

🎭 Example: The Ambitious Accumulator

Prompt to GPT:

"Act as a 40-year-old tech executive with high income, stock options, and an appetite for growth. Respond to my financial plan recommendations with excitement but also a tendency to want more aggressive strategies."

Advisor Input:

"We’ll allocate 60% equities, 30% bonds, 10% alternatives."

Simulated Client Response:

"That sounds balanced, but 30% bonds feels conservative. With my RSUs and career trajectory, shouldn’t I lean heavier into growth?"

Advisor Practice Response

- "I completely hear you — your appetite for growth and confidence in your career make sense, especially given your RSUs. What we need to keep in mind is that those RSUs already give you concentrated equity exposure, which adds growth but also risk if your company stock dips.

That’s why the 30% bond allocation isn’t meant to hold you back — it’s designed as a stabilizer. Think of it as strategic optionality: it gives you flexibility to reinvest during downturns while still keeping the majority of your portfolio in growth assets.

That said, we can model a tilt toward more growth — for example, shifting to 70/20/10 — so you can see the trade-offs in expected return and downside risk. Would you like me to run that comparison for you?"*

🤖 How AI Helps

- Persona Simulation – Play out tough client reactions before they happen.

- Message Refinement – Practice reframing conservative allocations as strategic advantages.

- Confidence Building – Enter client meetings ready with both logic and language that resonates.

⚡ Takeaway: With a Client Persona GPT, you don’t just practice the math — you practice the conversation. That’s what makes the difference in winning trust and guiding ambitious clients toward balanced decisions.

📌 Key Takeaways from this Issue

✅ Browsing reimagined: Perplexity’s Comet browser makes the web interactive, with built-in AI that researches, summarizes, and automates tasks directly in your workflow.

✅ A fairer AI economy: Comet Plus shares 80% of subscription revenue with publishers, signaling a shift from legal battles to sustainable partnerships between AI platforms and content creators.

✅ AI made affordable: OpenAI’s ChatGPT Go tier launches in India at just ₹399/month, offering GPT-5 access, file uploads, and longer memory — all in local currency and UPI payments.

✅ Planning goes hyper-personalized: Tools like Nitrogen and AI-driven engines transform financial plans from static PDFs into living, adaptive strategies that adjust to careers, markets, and client values.

✅ Practice the conversation, not just the math: With Client Persona GPTs, advisors can rehearse tough client reactions, refine messaging, and build confidence before stepping into real meetings.

👉 Forward this to a colleague who wants to stay ahead.

👉 Reply to share your biggest AI question — we might cover it next!

That’s a wrap for this week

Got thoughts or suggestions? I’d love your feedback to keep making Advisor Copilot better for you.

Cheers,

Neil Pradhan

Founder & Editor | Advisor Copilot